This is not meant to be a comprehensive list of every way you can make money from real estate. We’re focused on building long-term wealth. We really recommend long-term rentals residential for beginning investors and commercial as you gain experience, capital, and connections.

Let’s dive into some of the top strategies that we typically recommend. We’ll go over some less common strategies to start real estate investing in another post.

Commercial real estate

Commercial real estate investing means you’re investing in properties intended for commercial use or in other words, properties that will be used by businesses. These are properties like storage units, campgrounds, assisted living centers, office space, warehouse space, trailer parks, and large apartment complexes.

These are all great investments that can bring high rates of returns, and maybe you’ll want to dive into the commercial space one day, but it’s not a great place to start for beginners.

There are 2 main problems with the commercial space. First, it takes WAY more money to buy a commercial property. You can get into a residential property for a few thousand dollars, but for commercial, we’re talking hundreds of thousands even for the lower end of commercial investments. The exception to this is when you use other people’s money, but we’ll go into that in a different post..

The second problem with commercial investments is that they might require running a business on top of owning the real estate. If you own storage units, camp sites, or assisted living centers, you now have to pay for a billboard, mailers, digital ads, or other marketing. You probably have to hire employees, people to be on site and help your customers. You might have supplies that you need to keep stocked up. You might have to hire a lawyer to make sure you’re set up properly and meeting all the local requirements. Again, not a bad thing. Even with these extra complexities and expenses, you can still earn a huge return in the commercial space, but it’s just not beginner friendly.

Long Term rental

When you invest in real estate, you’re really starting a small business. Long term rentals are probably the most boring, basic, mundane businesses out there. And that’s exactly why we love them!

With most businesses, you need to stand out, you need to have something that makes you different or better than the competition, and then you need to pay for marketing to communicate that difference to potential customers and cross your fingers and hope your expensive marketing strategies actually work. Plus, anytime you do something new or innovative, you have to figure everything out from scratch. It takes a ton of time and trust us, it will wear you out!

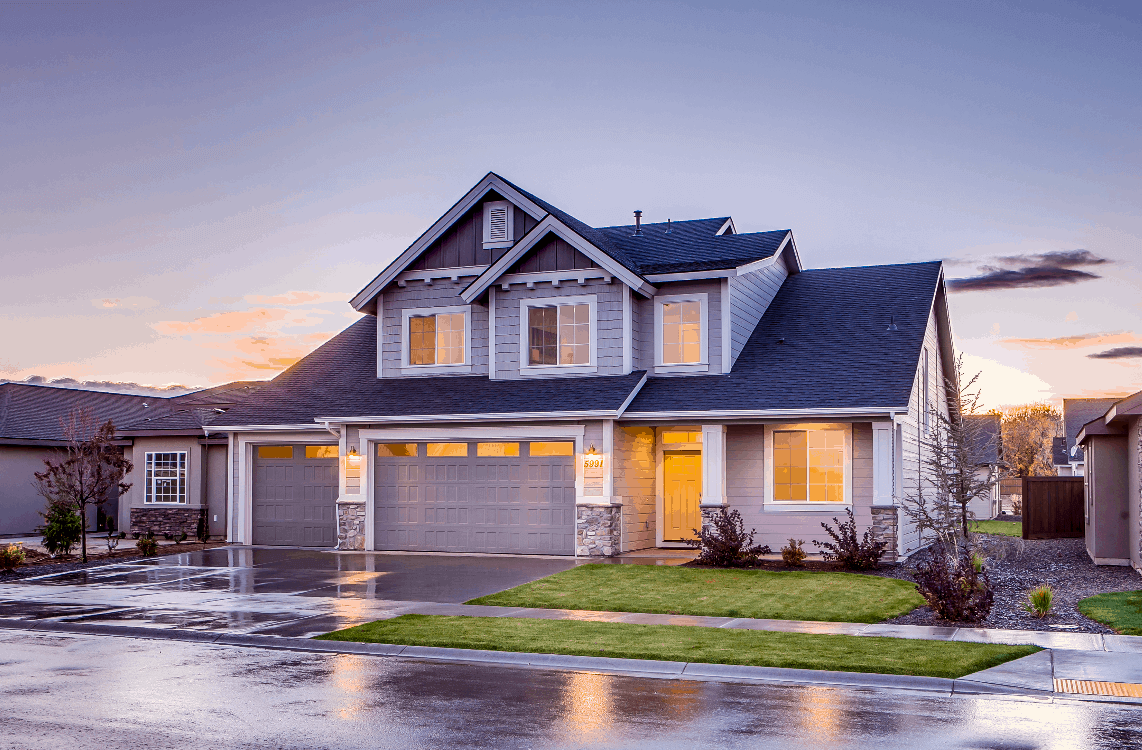

With long term residential rentals, you don’t have to do any of that. Just to be clear, when we say long term rentals, we’re referring to the strategy of buying a residential property that you rent out to someone with long term contracts. For example, you own an affordable house and rent that house out to someone for 1 year at a time.

Long term rentals are still technically a business, but you don’t have to deal with any of the crappy stuff. You don’t have to be different or unique. You don’t have to worry about marketing or convincing people that yours is better than theirs. You don’t have to worry about hiring employees or keeping supplies stocked up. You just own something that fulfills a basic human need. It doesn’t have to be special in any way, it’s just a place to live.

The fact that it has 2 bedrooms, 1 bathroom, and is relatively close to where they work is all it takes to have people want to buy your product. Sure, having a nicer unit might allow you to charge more for rent, but even ugly units still get rented by people who just need a place to live.

Plus, once you earn a customer or in other words find a tenant, you have a long-term contract so they will keep paying you again and again and again. You don’t have to re-earn their business or entice them to come back. And once they’ve lived there for a while, even when they COULD end their lease and live somewhere else, no one wants to move. They’d need a pretty good reason to want to pack up all of their stuff, throw it in their minivan, and take it a few blocks down to another place that also has 2 bedrooms, one bathroom, and is relatively close to their work. So they’ll probably just renew. You can even raise their rent to adjust for the market and inflation and they’ll still probably stick around. Once you get a customer or a tenant, you can pretty much just sit back and relax and smile every time you get a rent payment.

Not only that, but when the economy takes a dip, there’s a lot of things people will cut out of their budgets, but they will always need a roof over their head and a place to call home.

To make it even better, because long term rentals are so reliable and time tested, they are by far the easiest real estate investments to get financing for. In fact, they’re by far the easiest business model ever to get financing for.

Long term rentals are so easy, so boring, so simple and so consistent, and that’s exactly why they’re perfect for reaching financial freedom and being able to live your dream life.

Short term rental

Owning short term rentals or vacation rentals is a super trendy investing strategy, especially in the last few years. So what are the pros and cons of short term rentals, how do they compare to long term rentals, and which one is better?

People get really excited about short term rentals because the POTENTIAL cash flow is crazy. When you provide a fully furnished, top notch vacation experience, you can charge a lot more per night than you can with a long term rental. If you have a rental property that can earn $1,500 a month as a long term rental, that breaks down to about $50 / night. If you were to furnish that rental and add all the vacation experience touches, you might be able to charge $100 / night.

And since every extra dollar you collect in rent is pure cash flow, it might seem like a no brainer to invest in short term rentals. It’s true, short term rentals absolutely have the POTENTIAL for higher cash flow, and that is their biggest strength.

But vacation rentals have a long list of downsides that you need to fully consider before jumping in. Here are the top 6.

First, your income is not predictable like it is with long term rentals. You’ll have busy seasons and slow seasons. Sometimes it’s based on local weather. Sometimes it’s based on holidays and school schedules when families can travel like Christmas break, spring break, and summer break. We live near Salt Lake City and a lot of short term rentals here make the majority of their annual income during ski season. Without predictable regular income, short term rentals are much harder to rely on for early retirement unless you’re ok with a feast or famine lifestyle.

Second, vacation rentals are not as reliable as long term rentals. It’s still a relatively new industry and there are a lot of unknowns. Historical data shows that when the economy is bad, people still travel, but the type of travel they do changes dramatically. Instead of flying somewhere unique and staying somewhere fancy, families tend to stay within driving distance and stay somewhere more economical. The short term rentals that make the most money are the super expensive, unique and fancy rentals, but those are the exact ones that might suffer in a bad economy.

Third, it’s a fast changing industry. Local laws are changing all the time, sometimes in favor of short term rentals, but sometimes to their detriment. Hawaii, for example, is really cracking down on short term rentals. Initially, short term rentals in Hawaii were very profitable, but the local government didn’t like that investors were buying up all the local housing supply which affected the supply and demand curves and made housing for local Hawaiians even harder to find and more expensive. So they passed a law that restricted short term rentals to minimum stays of 30 days which really slowed down the Hawaii vacation rental market. Now the government there is pushing to adjust that law to require rental durations of 180 days or more which will totally kill the short term rental market there. And this same thing happens with smaller local governments. Southern Utah is a popular destination for national park lovers with Zion national park, arches national park, bryce canyon, and lots of state parks. You’d think it would be a great place for a vacation rental, and it was, until the local government made it illegal to have a short term rental unless you personally live there for over half the year.

Fourth, it’s getting competitive. Prices are always determined by supply and demand and with the growing popularity of investing in vacation rentals, nightly rates may start to drop as the supply in certain areas outpaces the demand.

Fifth, perception matters. You’re no longer just renting a 2 bedroom 1 bathroom apartment. You’re now selling an experience. The views, the decor, the exact location, and your host rating all have a massive impact on your success. And if you don’t nail these things, your only next option is to lower your nightly rate because some money is better than no money. No one wants to stay 2 blocks from the beach if there’s options that are on the water, unless their budget shoppers and your nightly rate is significantly lower. No one wants to stay in a place that has mediocre decor if there’s much more attractive options, unless you drop your price. And if you have a mishap and get a bad host review early on, you’re in a world of hurt because no one wants to stay at a poorly rated vacation rental unless it’s way cheaper. There’s just a lot of variables that you need to nail perfectly to be successful in this space.

And Sixth, there are way more moving parts. Instead of having a turnover once every year or 2, you have a turnover every few days. With each turnover you’ll need a full cleaning, laundry refreshed, supplies restocked, and repairs addressed. That means more to coordinate, more to keep track of, and more to stress about.

After hearing these 6 downfalls, you might think short term rentals suck, but that’s not true either. They’re a higher risk, higher potential reward investment.

House hacking

One of the most popular strategies we recommend for buying your first rental property is called house hacking. We recommend it because It’s flexible, easy to implement, crazy low risk, and works incredibly well.

House hacking is when you rent out a portion of your personal residence to offset the cost of your mortgage payment. Maybe you live in one side of a duplex and rent the other side out, maybe you have a single family home and rent out your basement. Maybe you just rent out storage space in your garage or shed. There are a hundred ways you can house hack depending on what you’re comfortable with and what opportunities your property has available.

If you’re interested in house hacking, be sure to pick the right property. Not all properties have the same house hacking potential. Properties with multiple living spaces work the best for house hacking. Renting out an auxiliary unit like a basement with a separate entrance is good, but buying a duplex or a triplex or a 4-plex is better.

The secret to house hacking is starting early. If you’re young and used to living in small grungy apartments, living in one unit of a 4-plex or the basement of a house isn’t a shock or big deal. But if you’re already accustomed to living in a nice spacious house, it’s really hard to give that up.

If you’re considering a house hack, be sure to check the local laws. In most places, you’re fine to rent out your basement to long term tenants, but short term rentals may not be allowed in your city or HOA. Also, if the property is zoned for single family, you’re fine to rent out the basement when you live there, but you might have an issue when you move out and treat that house like a duplex. It’s usually illegal to rent out a single family home to more than one family without a zoning variance. To get a variance or change the zoning, you might need utilities to be separately metered or fireproof berries between units or separate major appliances like water heaters or furnaces. Most of the time it’s not worth it to make these changes, so when you move out, you could rent the whole house on one lease, or just risk it treating it like a duplex and hope for the best.

House hacking is the cheapest and best way to get into your first few rental properties because it allows you to take advantage of owner occupied financing which means smaller down payments and more leverage. A smaller down payment means you can get started sooner, and more leverage means a higher rate of return. Plus house hacking is a great warm up to being a landlord since you’re right there with your tenants all the time and can take care of any issues that arise all by yourself with little effort.

If you’re willing to house hack, we 100% recommend it. The basic house hack is great, and it gets even better if you’re willing to house hack a multi-family property like duplex, triplex, or a 4-plex.

Straight up investment

The simplest way to invest in real estate is a straight investment. A straight investment is when you buy a property with the exclusive and immediate purpose of using it completely as a rental property.

The strategies we just covered involve buying a property first as a personal residence and then keeping it as a rental when you move out, but with the straight investment strategy, you buy a property that will immediately be a rental for you right when you buy it.

The straight investment strategy has 2 pros. First, you never have to live in the property you buy. This opens the doors to a lot more locations and a lot more property types. If you don’t live in it, it doesn’t matter if it’s near your school or work, it doesn’t matter if it’s old and grungy or too small for your family, it doesn’t matter if it’s in a scarier part of town. When it’s a straight investment, all your personal preferences can and should go out the window, and you can look exclusively at the numbers and how much money it will make you.

The second pro of a straight investment is that it’s simple with immediate results. Some of the more creative strategies we’ll go over in our next post require you to have a long term vision. You might have to pay your own mortgage for a year or two and navigate another purchase before you can move out and finally get cash flow from your first property. But with a straight investment, it’s a one step process. You just buy the property, and if you buy it right, it will start bringing in cash flow right away.

The biggest con of a straight investment is that it takes more money. Usually you’re looking at 15-25% down. Sometimes you can find attractive non-conforming loan programs like the 10% down Mountain America Credit Union loan we’ve used a bunch, but even that’s a lot compared to the 0% down, 3.5% down or 5% down loan options available for owner occupied loans.

Higher down payment requirements means more required cash, but it also means less leverage. And less leverage means less amplification, and less amplification means lower returns in appreciation which can be the largest money maker.

At the end of the day, straight investment properties are great because they’re simple and straightforward with immediate tangible results, but the strategy usually requires more up front capital and reduces the amount of leverage.

Your real estate coaches,

Dallas & Greg